An integral part of macroeconomics is understanding business cycles, i.e. figuring out what drives changes in aggregate output. We have devoted the last many years trying to understand why large declines in output and employment – as seen in the Great Recession – occur. In trying to answer such questions, a major obstacle in macroeconomics is the paucity of micro data. For example, while we know what happens to consumption in the aggregate, we do not have an accurate idea of movements in consumption at the neighborhood or even city level.

This is unfortunate because micro level data can greatly help us better understand the root causes of large falls in output and employment. For example, by comparing the neighborhoods that suffer the largest decline in consumption with neighborhoods that somehow escape recessionary consequences, we can hone in more precisely at the root cause of the problem. For example, if you have yet to raise your credit score, you will find it more difficult to avail yourself of financial facilities when lending requirements become stricter. It is a bit like an epidemiologist comparing subjects that seem immune to a virus with those who quickly succumb to the epidemic. It is clear that such evidence is critical to treating and preventing future outbreaks.

As a result we are always on the lookout for measures of economic activity at finer geographical levels like zip codes or counties. One of our favorite variables in this regard – and one that we have used very often in our research and book – is the number of new automobiles bought by residents of a given zip code.

Why, you might ask, does this particular data exist? The reason is that anytime someone buys a new car, they need to get it registered at the local motor vehicle authority, which in turn records the owners residential address. We can hence track on a monthly frequency the number of new vehicles bought by household in every zip code in the United States.

Is zip code level data on purchase of new automobiles useful for macro-economists? First, the bad news. Sales of new vehicles comprised only 2.9% of total GDP at the start of the Great Recession.

So one might think that looking at the sale of new cars is not very useful given how small a share they hold in the overall economy. But this intuition would be wrong. Remember that it is the change in GDP that we are truly interested in. And it turns out that as far as change in GDP is concerned, sales of new vehicles explain a large fraction. For example, the decline in the sale of new automobiles comprise 28.1% of the peak to trough fall in GDP during the Great Recession.

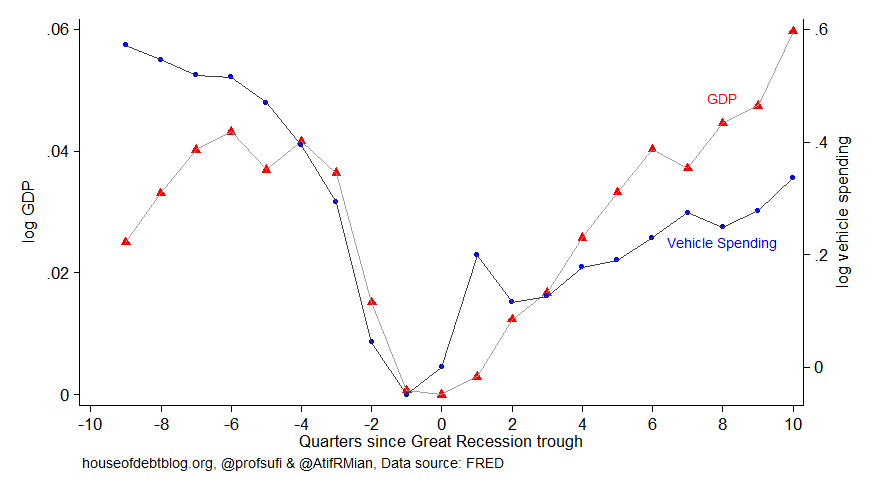

We can see the usefulness of new car sales for macro-economists more clearly in the graph below. It plots log GDP (left axis) and log vehicle spending (right axis) over time, with time (in quarters) indexed to zero for the trough of the Great Recession (2009Q2). Two things are worth noting. First, vehicle spending strongly co-moves with GDP, and in fact tends to lead the cycle. Second, the variation in vehicle spending is ten times as large as the variation in GDP. That is why we had to plot the two graphs on separate scales.

The net result is that new vehicle sales provide an extremely useful lens for figuring out what caused the Great Recession and hence what we can do to prevent such events from happening again. You will find a lot of mention of new car sales in our book. Now you know why we love cars.

By the way, if you know if a data source that measures household spending or consumption at a micro level, let us know in the comments or via twitter!