Great Recession happened in December 2007, where millions of people lost their job, house prices going down, people started looking at how to fix your credit, and economies went downhill. But did you know that some recession proof industries not just survived but somehow thrive during those unfortunate times compared to the negative impact it has caused the Housing Market?

One of the main arguments we have made in our research and book is that the growth in household debt and the subsequent collapse in house prices are crucial for understanding the Great Recession and the weak recovery afterward.

To illustrate this argument in the micro-data, we focus here on Chicago.

First, here is a zip-code level map of Chicago, plotting median household income. The darker shades of green are the poorest zip codes. We have labeled a few of the zip codes just to familiarize the non-Chicago readers. The south side neighborhoods are Oakland/Bridgeport, Hyde Park (home of the University of Chicago), Washington Park, and Englewood (where Derrick Rose is from). The north side neighborhoods we’ve labeled are Lincoln Park, Lakeview, and Rogers Park. The poorest neighborhoods in Chicago are on the south and west sides, whereas the richest are just north of downtown.

We know there was a boom in mortgage credit from 2002 to 2006. Where was it strongest? In the following map, darker shades of green are where mortgage credit grew most:

Mortgage credit growth from 2002 to 2006 was strongest in the lowest income neighborhoods. This was one of the first patterns we saw in the data back in 2007 when we started working on household debt issues. It was the basis of our research published in the Quarterly Journal of Economics. The basic point was that mortgage credit was growing most during the housing boom in the poorest neighborhoods, despite the fact that these neighborhoods were seeing no improvement in income.

So what happened during the housing bust? Here are foreclosures by zip code, with darker green zip codes being the worse hit areas. Mortgage credit was expanding in poor neighborhoods despite no real income growth, so we shouldn’t be surprised that foreclosures were also much higher in those same neighborhoods:

And what about spending? We only have spending data for new autos at the zip code level. But it shows a very clear pattern. Purchases of new automobiles fell most in the the same poor zip codes that had the largest increase in mortgage debt followed by a spike in foreclosures:

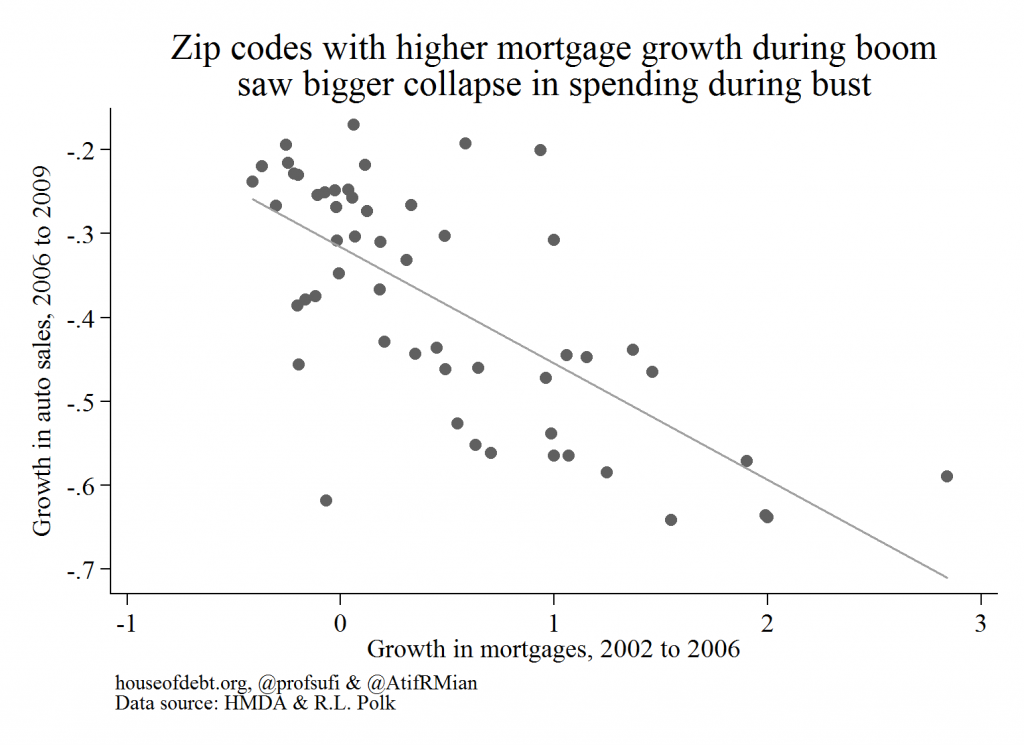

This generates a very strong relationship between debt growth and the collapse in spending, as can be seen in this scatter plot. Each dot is a zip code, and it shows that zip codes that had the largest increase in mortgage debt during the housing boom were exactly the zip codes that saw the largest collapse in spending on new autos during the bust:

We have focused on Chicago just to give one example. The patterns we show here are robust across the country. It is pretty clear that the debt boom and housing collapse are central to explaining the Great Recession (we detail more of the evidence in our new book, now available on Amazon) nearly 8.7 million Americans lost their job. Can other theories of the cause of the recession explain these patterns? Did neighborhoods on the south and west side of Chicago cut spending because of the collapse of Lehman Brothers? Did these areas suffer because of policy uncertainty? Because the monetary policy was too tight? Perhaps these problems exacerbated the recession. But the central role of excessive debt and the housing collapse is immediately obvious in the data.