Census retail sales for May came out today, and they missed the consensus forecast slightly on the downside. But there is another pattern that may be more concerning. Let’s take a closer look at what has been going on with household spending.

First, new auto purchases have been an important driver of household spending for the past two years. The chart below plots year over year spending (in nominal terms) from January to April for 2013 and 2014. The blue bar shows total spending, and the red bar shows spending excluding new auto purchases.

Over the past two years, nominal spending growth has been about 3% on a year-over-year basis. But if we exclude auto sales, the numbers are much worse, especially for 2014. Spending excluding autos in the first four months of 2014 has been less then 1.5% nominal, which implies a decline in real terms. This includes March and April, so it is hard to argue that weather alone explains this weakness.

So purchases of new vehicles have been an important boost to household spending and the overall economy. But what is driving this great performance of auto sales? A clue comes from looking across zip codes that differ in credit scores.

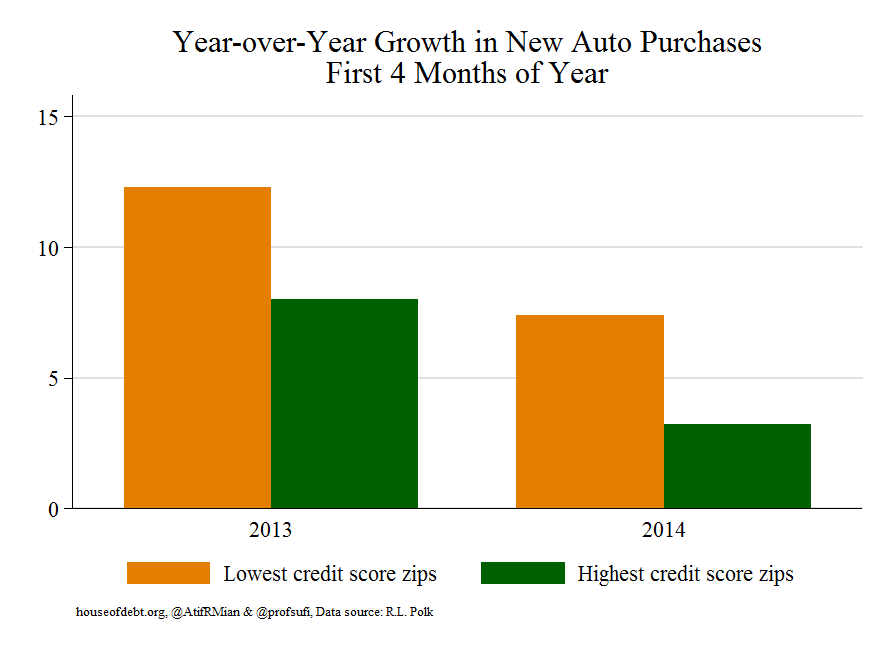

In the chart below, we plot the year-over-year growth in new auto purchases for the lowest and highest credit score zip codes. These are the bottom and top quartile of the overall credit score distribution, where the quartiles are population weighted to ensure we are looking at the same number of people.

The growth in new auto purchases has been much stronger in low credit score zip codes over the past two years. In 2014, the growth was more than twice as strong in low credit score zips relative to high credit score zips.

So total spending is being driven in large part by auto purchases, and auto purchases are being driven in large part by purchases by low credit score individuals. What explains this pattern?

A very sharp rise in auto loans, especially to low credit score individuals. We showed this pattern in a previous post. It also makes intuitive sense. Wage growth has been pretty stagnant, especially among middle and lower income Americans. So it makes sense that the only way low credit score individuals (apart from credit repair) are able to buy cars is by taking on debt. They certainly haven’t seen improved income.

So what is the big picture? One view is that all of this is benign. Credit conditions were overly tight during the Great Recession, and now credit is flowing back to low credit score individuals who are purchasing cars at a fast clip. We should expect durable purchases by low credit score individuals to help fuel a spending recovery.

Another view, closely related to the secular stagnation idea, is that the only way we can generate real demand is by lending to individuals that have low income and low income prospects. The financial system is channeling funds toward individuals for whom economic circumstances remain poor, which offers only a fleeting boost to spending. This is closely related to arguments we make in our new book, House of Debt.

Can debt-fueled purchases of new autos continue to drive the spending recovery? This is a pattern worth watching closely.